Data

Data Analysis

Modeling Strategy

Feature Engineering

Feature Selection

Modeling

Validation

Models

(Downloadable)

Thoth- A No-code ML Modeling and Advanced

Analytics Platform for the BFSI sector

Intuitive UI Wrapped Around Monsoon’s Powerful ML Pipelines

1

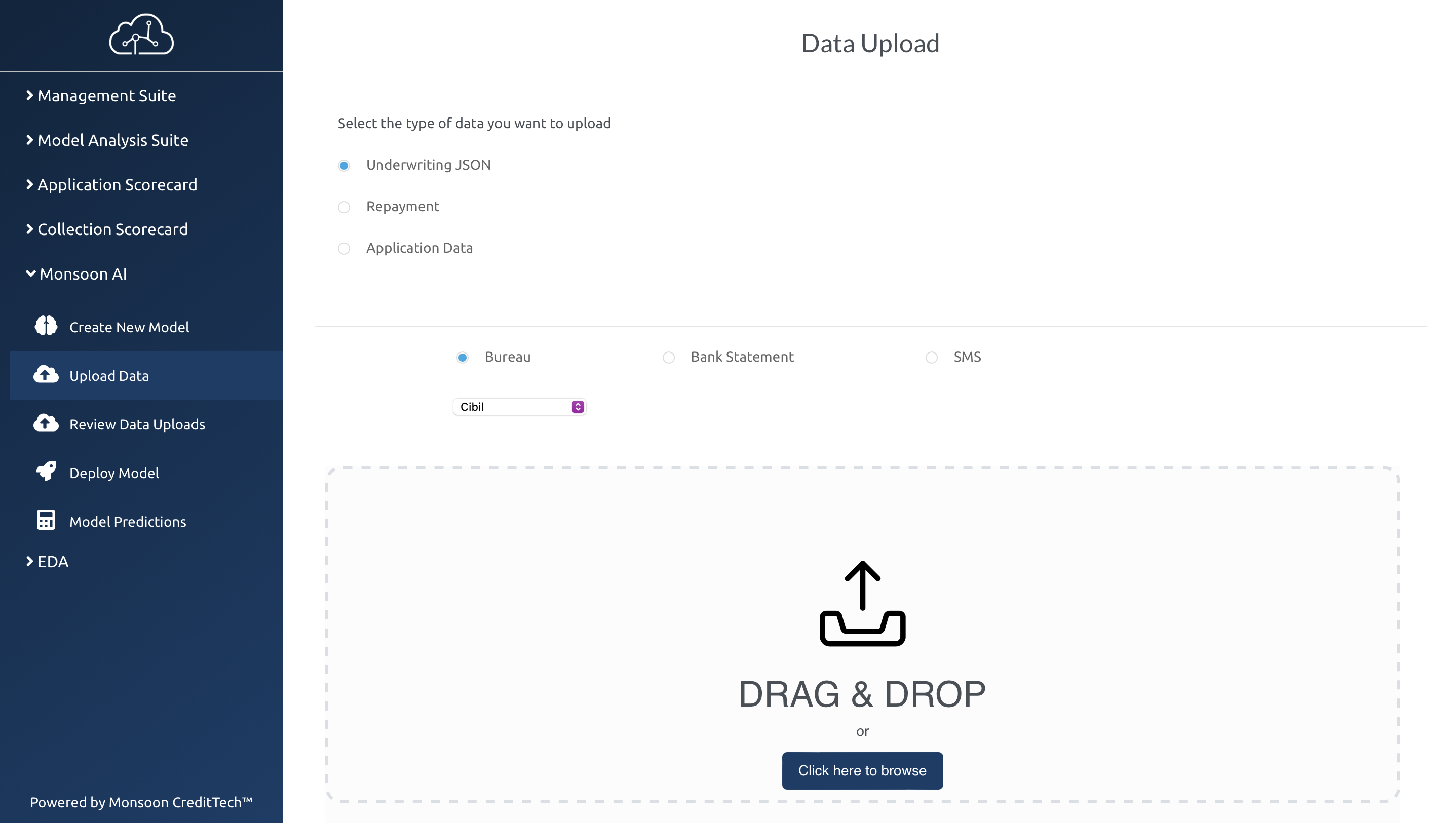

Data Upload & Review

A Business User with no coding experience uploads data to the Thoth platform. Thoth’s Data Upload feature allows users to effortlessly upload diverse types of data into the system. Thoth’s Review Data Uploads feature serves as a tool for users to manage and verify the uploaded data files. It provides a comprehensive overview of the uploaded data, allowing users to edit, sort and delete the data.

2

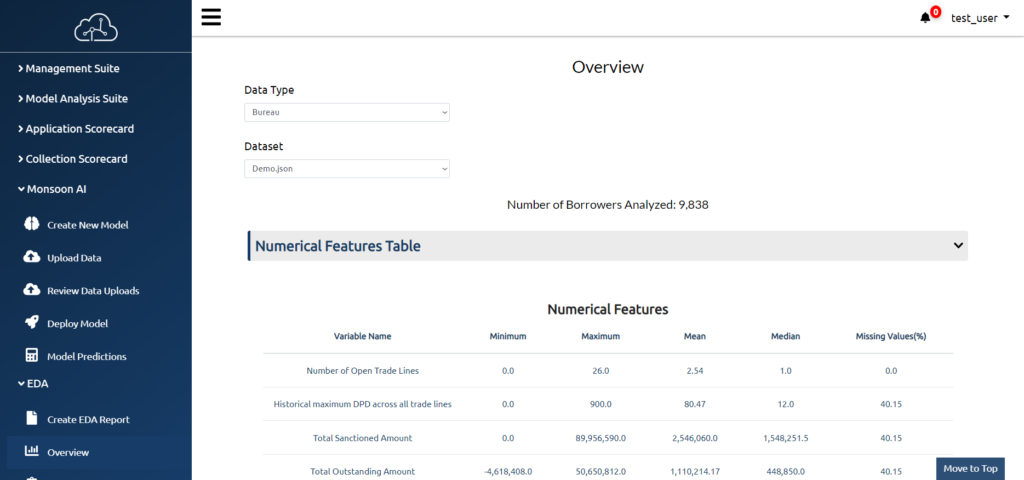

Exploratory Data Analysis (EDA)

Thoth’s EDA provides users with powerful insights into your data. By leveraging advanced analytical techniques, Thoth’s EDA module enables you to uncover meaningful patterns, trends, and relationships within your dataset.

3

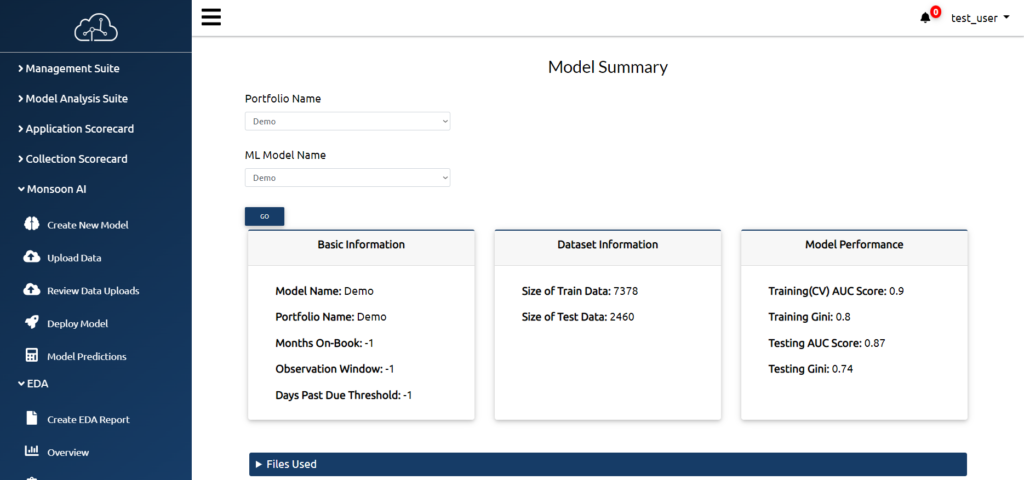

Model Creation

The Business User uses a web-based GUI to choose from a range of options to build the type of model he/she wants. The model is built and is ready for validation via the Thoth Validation Workbench( GUI) within 2-4 hours. The user can also get essential insights into their model through the Model Logs feature in Thoth.

4

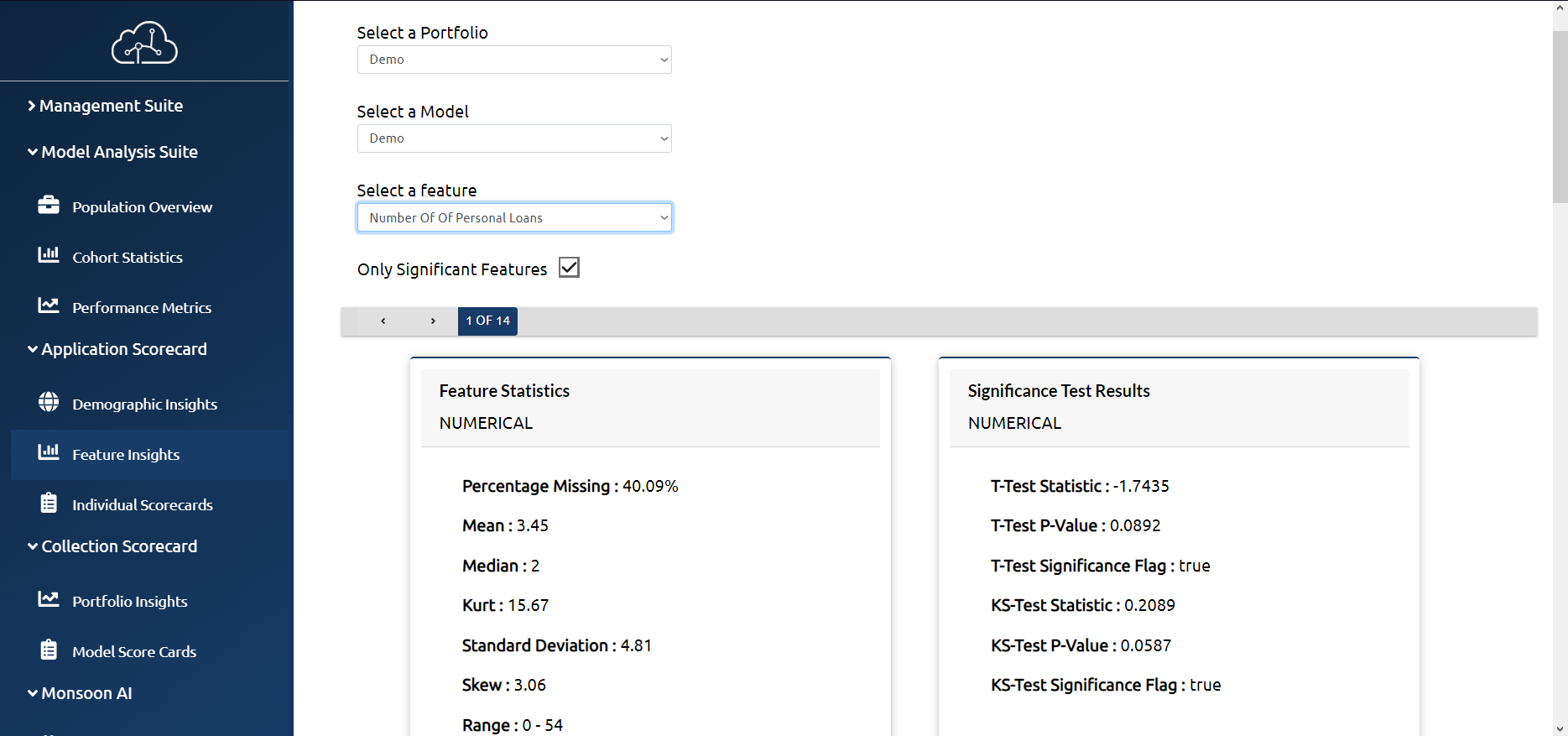

Model Analysis & Application Scorecard

Enables our clients to gain deep insights and evaluate the performance of their machine learning models and helps the user to effectively evaluate applications by providing the probability of default, factors that increase the customer’s risk and one’s which reduce the risk to help make the decision to lend to the borrower or not.

5

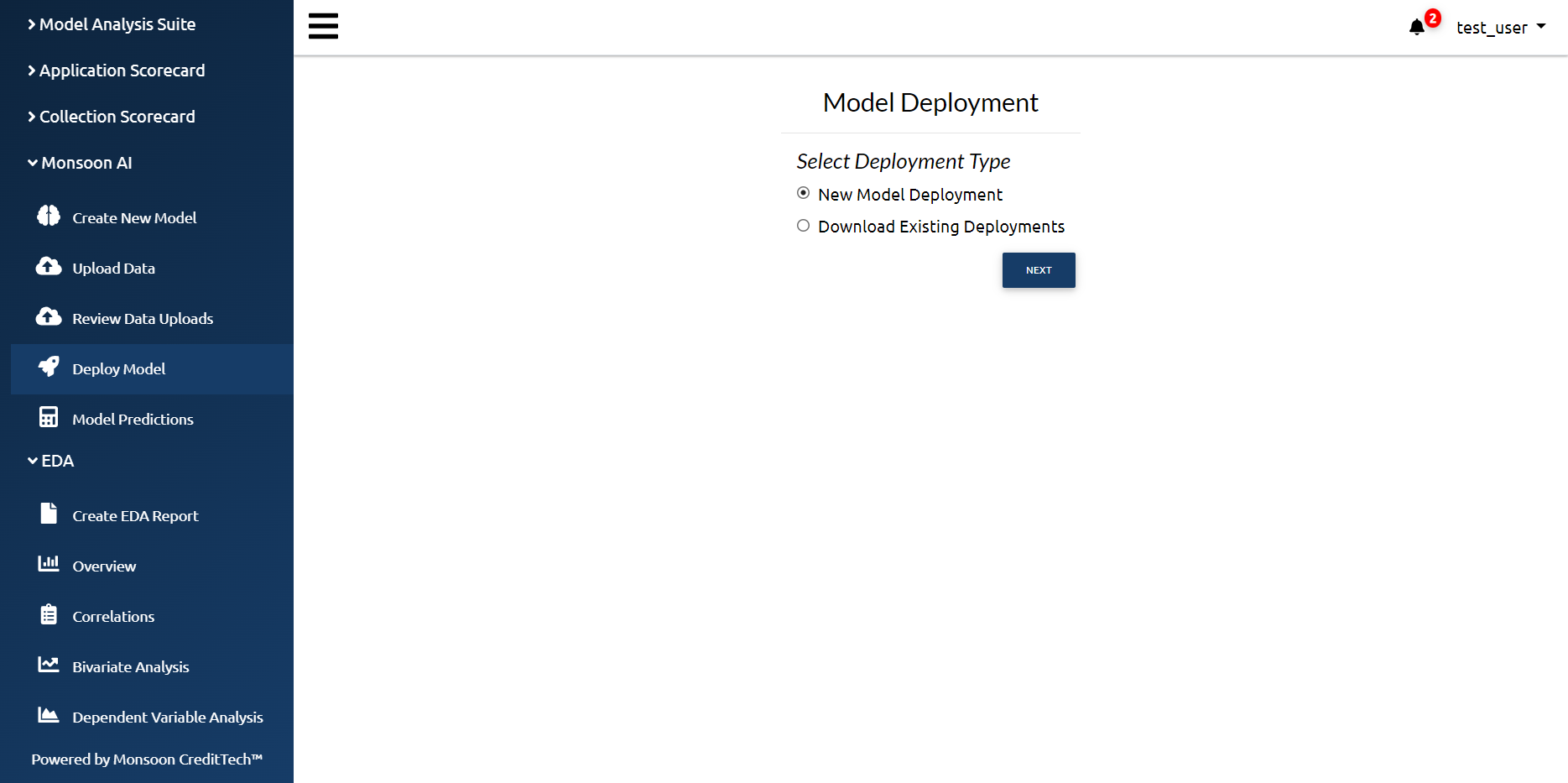

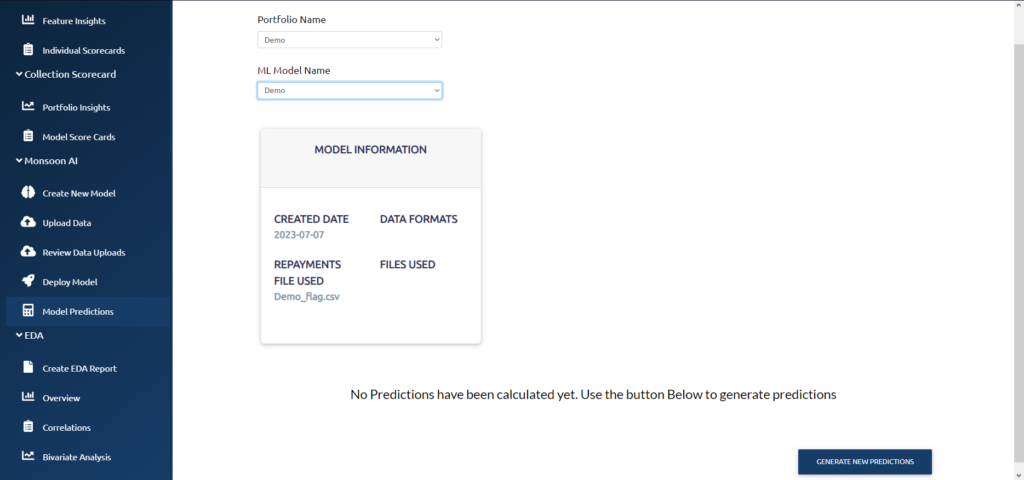

Model Deployment & Prediction

After iterations, the final model can be downloaded and deployed. Thoth’s Deploy Model feature empowers users to seamlessly integrate machine learning models into their applications or systems.

What types of data are supported?

Financial Data

Credit History

Bank Statements

Application data

Alternate Data

SMS data

Fastag Data

UPI data

GST Data

Value Proposition for Lenders

Features of Thoth

- Monsoon’s Thoth lets you go from data upload to model download in 4-6 hours.

- Thoth’s extensive analytics suite allows you to slice and dice data right down to the last granule.

- Thoth is a no-code workbench meant for business users.

- Thoth allows users to build 15 different types of models e.g. Application Scorecards, Behavioral Scorecards, Collections Scorecards etc.

Value Created for Lenders

- Slashes the time taken to build predictive ML models from 2-4 weeks to 4-6 hours.

- Lets you out your hypotheses quickly (within hours) by building models and evaluating their performance on sub-sections of data.

- The user need not be a Data Scientist or a Technologist. Thoth Minimizes the need for specialist Data Scientists/ Data Analysts and cuts costs

- Thoth is the one-stop solution to all your modeling and analytics needs in the BFSI space

Key Models that can be built on Thoth

Application scorecards

Use data such as Bureau data, Banking data and/or alternate data to enable quick approval of safe loan applications and rejection of risky ones.

Behavioral Scorecards

Use Bureau data, transaction data and past repayment behavior to predict the risk of existing loans on book, enabling timely intervention.

Collection scorecards

Use bureau data, past repayment data and responses to collection efforts to predict which customers will miss the next payment.

Pricing Models

Risk based pricing models enable you to price loans (interest rates, LTV, tenures on the basis of customer risk) and pricing power.

Cross Sell scorecards

Customer Attrition Models

pre-approval models

Help raise book-size with minimal risk by pre-approving customers from liability base for asset side products

Early Warning Models

Similar to behavioral scorecards but also account for infant-delinquency i.e. delinquency within the first 1-2 months of disbursal.